A calendar spread is one of several spread trading strategies used by both intermediate and experienced traders. The calendar spread involves the simultaneous purchase and sale of options with the same strike price but different expiration dates. The calendar spread is also known as a horizontal spread because when viewing a table or chart representing the spread, you could draw a horizontal line between the strike price in the earlier dated option and the same strike price in the later dated option.

Understanding Calendar Options Spreads

A calendar spread involves buying a longer-term option and selling a shorter-term option with the same strike price. The appeal of this strategy lies in capitalizing on the differing rates of time decay (theta) between the two options. The sold option with the nearer expiration date will experience faster time decay compared to the bought option with the later expiration date. This strategy may also rely on increase in volatility (IV expansion) to make the trade worthwhile regarding risk-to-reward.

Comparing it to other spread strategies, the calendar spread may not be your best strategy based on the parameters that must be met for the trade to be reasonably profitable.

Building Blocks of Calendar Spreads

When selecting the underlying asset, you need to consider the potential range of the stock price over the time frame being selected. When selecting a strike price that is close to at the money (ATM), the trade is most successful if the underlying stock price remains relatively stagnant through the timeframe up to the expiration of the earlier sold option.

When choosing expiration dates, it is important to provide enough time difference between the two options to make the time decay value worth enough to take the trade.

Implementing Calendar Spreads

Calendar spreads can be either call calendar spreads or put calendar spreads. It all depends on your outlook for the underlying stock. For call spreads, the trade is more likely to succeed if your short-term outlook is neutral to bearish, but long-term is bullish. While for put spreads, your near-term view for the stock is neutral to bullish, but longer term is bearish. These are both debits and therefore the max loss on the trade is the cost of purchasing the trade.

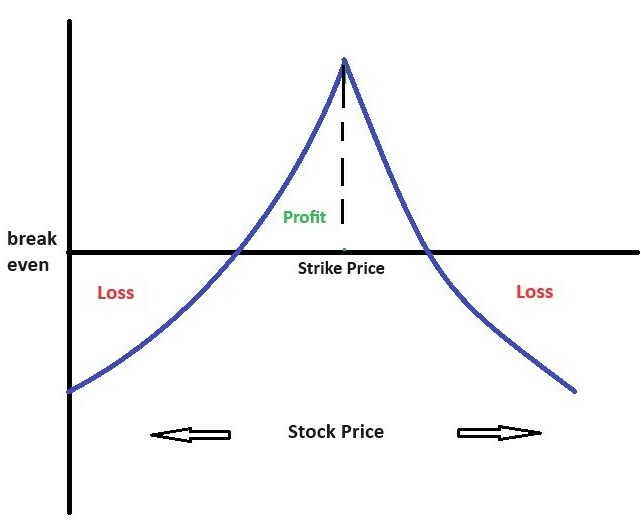

One example of a call calendar spread strategy is to buy to open (BTO) an at the money (ATM) option that is about 6 weeks until expiration. You would then sell to open (STO) the same strike price option that is about 3 weeks until expiration. Below is a simplified, typical profit/loss risk profile for the trade.

Some things to consider for getting the best entry price for the trade are making sure there is a tight bid/ask price, entering only at or close to the bid. You should be looking for liquid stocks (ideally >1 million shares traded per day) with liquid options at that strike price for the expiration dates selected. As always, use high quality charting tools, such as TradingView and FinViz to aid in your technical analysis.

Management of the Trade

Calendar spreads profit from time decay. As time passes, the value of the short-term option in the spread decreases faster than the value of the long-term option.

Set predefined criteria for when you’ll adjust or exit the trade. This could be based on the percentage of profit or loss, changes in volatility, or time remaining until expiration.

As the options approach expiration of the shorter term sold option, you can choose to close the entire position. Ideally, the short-term position is expiring worthless. You could also leg out of the position. This means closing the short-term position and remaining in the longer-term position if you are projecting the stock to trade in your favor going forward. The trend (up for calls or down for puts) would need to be sufficient to overcome the decay from theta on that bought position.

Another alternative would be to roll a call calendar spread lower or roll the put calendar spread higher. For the call calendar spread, it could be rolled lower if the underlying stock price lowers. The short-term call could be purchased and resold at a lower strike price to collect more credit. Ideally, the stock still closes below the short option strike price, so it expires worthless. For the put calendar spread, it could be rolled higher if the underlying stock price rises. The short-term put could be purchased and resold at a higher strike price to collect more credit. Ideally, the stock still closes above the short option strike price, so it expires worthless.

Stay updated on market news, economic indicators, and events (such as earnings reporting) that could impact the underlying asset of your options trade. This information can help you make informed decisions about managing your calendar spread.

Calendar spreads are often slower-moving trades compared to other options strategies. Depending on how far out you chose expiration dates you may need to be patient and avoid making impulsive decisions based on short-term market fluctuations. Stick to your trading plan and strategy to avoid making decisions based on emotions. As with all trading, your trading psychology with options spreads can make or break your ability to be successful.

Risk Management and Position Sizing

Similar to many other options strategies, profits are capped with calendar spreads. However, if you hold onto the long-term position after closing the short-term one, you can potentially realize unlimited returns, but it can also result in a larger loss.

Options involve leverage, offering the opportunity for substantial returns within a short timeframe. Conversely, this also means the risk of significant losses in a short period. It’s advisable to practice paper trading with this strategy before committing real money.

Real-world Example

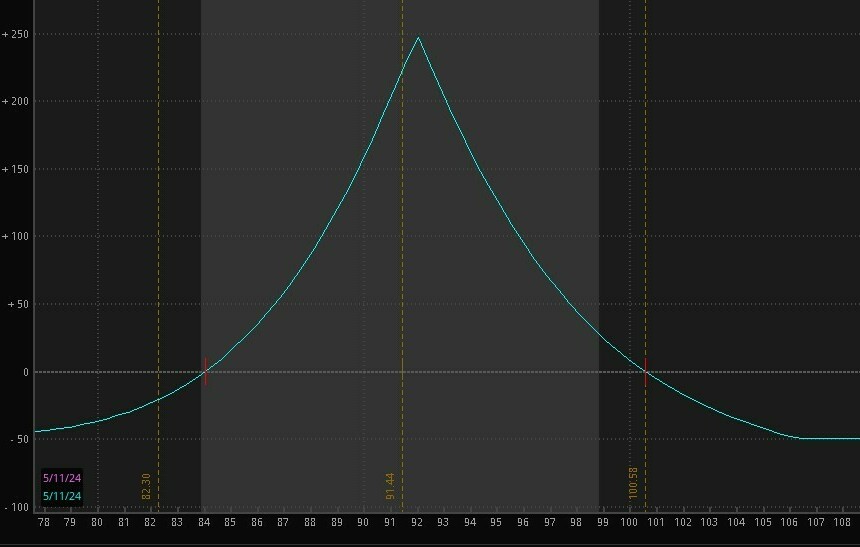

Here is an example of a call calendar trade and the associated risk-to-reward profile. The underlying stock is currently trading at $91.33. The trend has been relatively stable for the last month. There are no earnings reports for the company due over the next two months.

You could enter a call calendar spread at a strike price of $92 with expiration of the short-term contract 3 weeks out and the long-term contract 6 weeks out for a net debit of $50 per contract. As you can see from the chart, the max loss would be $50 per contract, unless you leg out of the trade and hold the long-term position beyond the short-term expiration. Your max profit at this point in the trade would be $190 per contract. The break-even point is approximately plus or minus $5 from current stock price (<$87 or >$97).

Conclusion

Calendar spreads are one of the potential tools you can use to be a successful options trader. They provide a unique opportunity to capitalize when you expect the underlying stock to remain relatively constant and that there will potentially be an IV expansion. As always, use available technical analysis tools to aid in your determination of the forecasted price of the underlying stock and use good risk management techniques to maximize gains and minimize losses if the trade does not work in your favor.

**Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to bring you quality content.**

Thank you for this detailed post on the Calender Spread option strategy. The graphs and the real-life example made the concept easier to comprehend and grasp.

Options are very useful tools for managing risk so I clicked on the link in your post to the 5+ Powerful Trading Indicators. I will likely explore the 30-day risk-free offer since they claim to be able to assist users make high profits by predicting any trading market with up to 93% accuracy.

Thank you for your thoughtful comments, Oluseyi. There are many strategies available to trade stocks and options, so it is important to find the one or several that best fit your trading style and risk tolerance. I always recommend paper trading with a simulated account for a period of time when trying any new strategy. Take care!

Robert

Hi,

This is a great comprehensive guide to Calendar Spread Option Strategy. You have described all the intricacies involved in employing this trading strategy, from understanding its building blocks to implementing it effectively. The emphasis on risk management and position sizing underscores the importance of prudent decision-making in options trading.

I really felt that your post can be a good resource for both intermediate and experienced traders seeking to expand their repertoire of trading strategies.

Thank you for your feedback on this article Scott. It is important for me to hear what users get from the content in order to make sure I am providing value for your time spent reading it.