At its core, stock option trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell a stock at a predetermined price before a specified date. These contracts are known as options, and they come in two main flavors: calls and puts.

When you buy a call option, you’re essentially placing a bet that the stock’s price will rise above the strike price by the option’s expiration date. On the other side of the spectrum, purchasing a put option signifies your expectation that the stock will fall below the strike price within the same timeframe.

Each option contract is ultimately a tug-of-war between intrinsic value, or the current profit if exercised, and time value, which reflects the potential for profit before expiration. As time ticks away, the pressure mounts for the option to move in the buyer’s favor.

The world of options is a microcosm within the broader financial landscape but a powerful one at that. These contracts serve various purposes, from speculative ventures to hedging, allowing investors to potentially profit or protect against price movements in the stock market.

Evaluating the Risks and Rewards of Options Trading

In the world of stock options, potential rewards may come with significant risks. It’s crucial for traders to weigh these carefully to make informed decisions. One aspect that attracts many to trading options is the leverage effect. By investing a relatively small amount of capital, you can control a proportionally larger value of stocks. However, this leverage works both ways; it can amplify gains when predictions are spot on, but it can also magnify losses when the market moves against you.

Options prices are highly sensitive to volatility – the degree of variation of a trading price over time. High volatility often indicates a larger price range, which can affect both the price of options and the strategies traders use. An option’s value can swing dramatically in volatile markets, making it imperative to understand and anticipate these shifts.

Time decay, represented by the Greek letter Theta, is another inherent risk of options trading. Options are “wasting assets”; their value diminishes as the expiration date approaches. If other factors don’t change favorably, an option can lose value even if the underlying stock price remains static, directly impacting profitability.

An effective risk management strategy can mitigate some of these risks. This typically includes setting stop-loss orders, only investing capital you can afford to lose, and never putting all your eggs in one basket. Diversification across various assets and adopting multiple strategies can help manage and spread risk.

Developing a Strategic Approach to Options Trading

When I step into the world of options trading, I don’t just rely on luck; I come armed with strategies. It’s knowing the right move at the right time that separates the successful traders from those facing repeated setbacks. It’s critical for you to grasp the different options strategies available, as this understanding serves as your playbook for making informed and tactical choices.

For instance, if the market’s mood swings upwards and optimism abounds, a ‘bullish’ strategy like buying calls or employing a bull spread may bode well for your portfolio. On gloomier days, when bearish sentiment takes over, you may resort to buying put options or setting up a bear spread. And for the days when the market can’t quite make up its mind, ‘neutral’ strategies like iron condors or butterflies can help you capitalize on the lack of significant movement.

Beyond market sentiment, technical analysis provides a visual approach to examining stock charts for patterns and trends that may indicate future moves. On the other hand, fundamental analysis looks at economic indicators, earnings reports, and other data to gauge a stock’s underlying value. Both methods offer different lenses through which to view the potential of an options trade.

But like any seasoned trader will tell you, it’s not enough to have a strategy; discipline is the spine that supports your trading endeavors. A robust trading plan, detailing your entry and exit points, investment size, and criteria for managing trades, is your blueprint for keeping your emotions at bay. It ensures your actions are led by logic rather than instinctive reactions to the market’s ebb and flow.

Navigating the Options Trading Platform

I’ve covered the essentials of stock option trading, from the basics of calls and puts to crafting a strategic approach tailored to various market scenarios. Now, I’m going to share insights on one of the most critical components for every options trader: the trading platform.

Choosing the right platform is NOT a minor detail; it’s a decision that can significantly impact your trading success. You want a platform that’s intuitive, reliable, and equipped with the tools to analyze and execute trades effectively.

You’ll want to look for certain features in a trading platform. Charting tools, real-time data, educational resources, and trade alerts are just a few of the essentials. The ability to customize your trading interface can also drastically improve your trading experience.

When you’re ready to place an options trade, the steps should be clear and simple. Look for platforms that provide straightforward instructions and the ability to test trades with paper trading before you commit real capital.

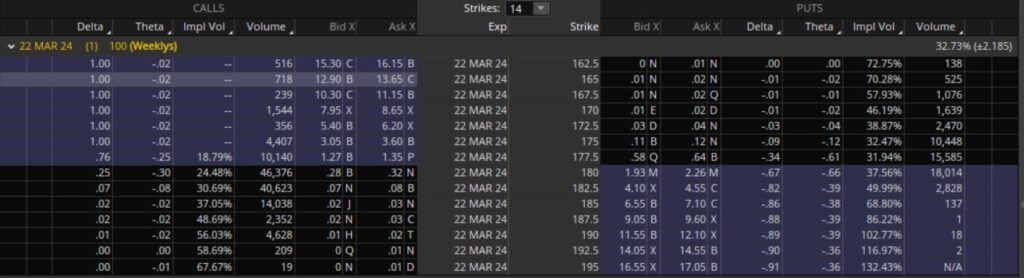

Lastly, utilizing options data effectively is crucial for informed trading decisions. A platform that offers detailed option chains, including Greeks and implied volatility, will give you a significant edge.

**Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to bring you quality content.**

Trading is a big business and it is one of the quickest ways to build wealth but at the same time, you can lose a lot so you must know what you are doing before going for the dive. It is good to know that you have written this post to inform others who are thinking about trading so they will know the pros and the cons.

Thank you for your comments on this article Norman. I appreciate your feedback as I strive to continue providing quality content on the topic of stock and options trading.

Robert

You have given a great overview of options trading. I have often flirted with the idea of getting on a platform and learning how to trade stocks. I usually end up with cold feet and decide to leave it to my professional wealth manager. Are there other good resources you can point me to learn how to do this? Perhaps you have some other helpful resources for training on your site?

Absolutely, I understand that diving into stock and options trading can feel daunting, especially without the proper knowledge and guidance. Here are some additional resources and tips that can help you gain confidence and proficiency in trading stocks:

Books: There are numerous books available that cover various aspects of trading. Some recommended titles include “Trading in the Zone” by Mark Douglas, “Technical Analysis of the Financial Markets” by John J. Murphy and “Understanding Options 2nd edition” by Michael Sincere. These books provide valuable insights into trading psychology, principles, and strategies.

Virtual Trading Platforms: Many brokerage firms offer virtual trading platforms that allow you to practice trading stocks with virtual money. This is an excellent way to familiarize yourself with the trading process and test different strategies without risking real capital. Some popular trading platforms include thinkorswim by TD Ameritrade/Charles Schwab and TradeStation.

Professional Mentors: Consider finding a professional mentor. A mentor can provide personalized guidance, share their experiences, and help you navigate the complexities of stock trading.

As for resources on my website, I offer a variety of articles aimed at helping individuals improve their stock trading skills. I continually add new content to improve the learner’s experience. Feel free to explore the resources available on my site, and don’t hesitate to reach out if you have any specific questions or topics you’d like to learn more about.

Remember, learning how to trade stocks is a journey that requires patience, dedication, and continuous learning. Start with the basics, practice regularly, and gradually expand your knowledge and skills over time. With perseverance and the right resources, you can become a confident and successful stock trader.