Vertical Spreads are options strategies that involve buying and selling multiple options of the same underlying asset, with the same expiration date, but at different strike prices. Whether you’re bullish, bearish, or neutral on a particular stock or index, vertical spreads offer a structured way to profit from your trade. The risk is limited to the net cost of entering the position and that gives you better control over potential losses.

Understanding and Selecting Vertical Spreads

When you trade vertical spreads, it’s important to know which type aligns with your outlook on the overall market and the specific stock or ETF you will be trading. Big picture, there are two types of vertical spreads: bullish and bearish. The bullish spreads are designed to profit when the underlying asset’s price is neutral or rises, while bearish spreads profit when prices are neutral or fall.

One of the key decisions you’ll make is selecting between a credit spread and a debit spread. Debit spreads have you paying for the higher-priced option while selling the lower-priced one, resulting in a net debit from your account. These include buying vertical call spreads or buying vertical put spreads. While credit spreads involve selling a higher-priced option and buying a lower-priced one, receiving a net credit to your account. These include selling vertical call spreads or selling vertical put spreads.

I’ll be covering both buying and selling strategies for both calls and puts.

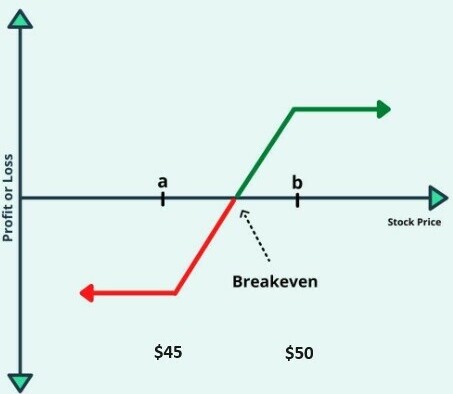

Buying Vertical Call Spreads (Bull Call Spreads):

In a bullish market outlook, traders employ this strategy to capitalize on steady to upward price movements while mitigating downside risk.

Let’s say you’re bullish on a stock, but you also want to limit your potential losses. You could buy a vertical call spread. For example, if XYZ stock is trading at $50, you could buy a $45/$50 vertical call spread expiring in one month (also called a $5 wide spread, which is the difference between $45 and $50).

This involves:

- Buying a $45 strike call for $6.

- Simultaneously selling a $50 strike call for $3.

Your net cost would be $3 ($6 – $3) or $300 per contract. If the stock price remains above $50 by expiration, your maximum profit would be the difference between the strike prices minus the cost of the spread ($50 – $45 – $3) or $200 per contract. For one contract, this means you would be risking a potential max loss of $300 for a potential max gain of $200. This is a good strategy if you believe support exists at $50.

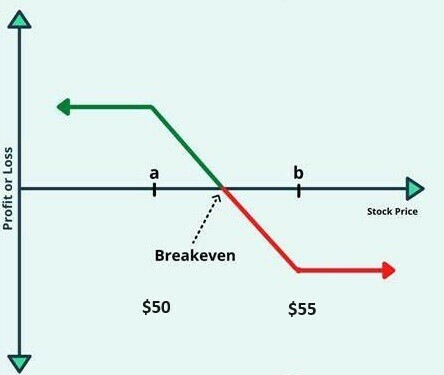

Buying Vertical Put Spreads (Bear Put Spreads):

A bear put spread involves buying a put option with a higher strike price and selling a put option with a lower strike price. With a bearish outlook on the underlying stock or ETF, this trade provides potential profit if the price goes sideways or down. The purchased put provides downside protection, while the sold put generates income and offsets the cost of the trade.

For example, if ABC stock is trading at $50, you could buy a $55/$50 vertical put spread expiring in one month. This involves:

- Buying a $55 strike put for $5.

- Simultaneously selling a $50 strike put for $2.

Your net cost would be $3 ($5 – $2) or $300 per contract. If the stock price remains below $50 by expiration, your maximum profit would be the difference between the strike prices minus the cost of the spread ($55 – $50 – $3) or $200 per contract. If the stock price remains above $55, your max loss would be $300. Consider this strategy if there is resistance at the $50 area.

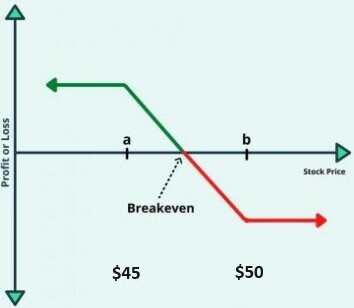

Selling Vertical Call Spreads (Bear Call Spreads):

A bear call spread involves selling a call option with a lower strike price and simultaneously buying a call option with a higher strike price. This strategy is implemented when a trader anticipates that the price of the underlying asset will decline or remain relatively steady. By selling the call with the lower strike price, the trader collects a premium, while the purchased call limits potential losses if the stock price were to unexpectedly rise.

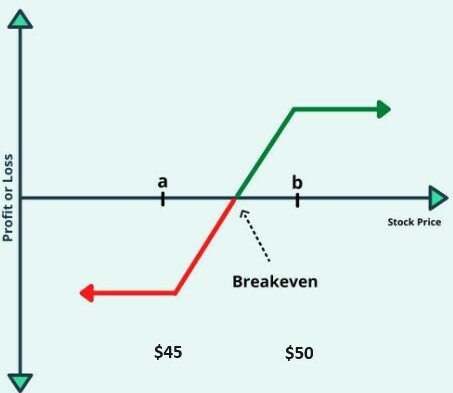

If you believe a stock will remain below a certain price level, you could sell a vertical call spread to profit from the premium. For example, if stock LMNO is trading at $45, and you think it won’t rise above $45 by expiration, you could sell a $45/$50 vertical call spread expiring in one month. This involves:

- Selling a $45 strike call for $3.

- Simultaneously buying a $50 strike call for $1.

Your net credit would be $2 ($3 – $1) or $200 per contract. If the stock price remains below $45 by expiration, you would keep the entire $2 per share. However, if the stock price rises above $50, you would incur maximum loss.

Selling Vertical Put Spreads (Bull Put Spreads):

A bull put spread consists of selling a put option with a higher strike price and simultaneously buying a put option with a lower strike price. This strategy is used when a trader believes that the price of the underlying asset will increase or remain relatively stable. By selling the put with the higher strike price, the trader receives a premium, while the purchased put limits potential losses if the stock price were to unexpectedly drop.

If you believe a stock will remain above a certain price level, you could sell a vertical put spread to profit from the premium. For example, if GHI stock is trading at $50, and you think it won’t fall below $50 by expiration, you could sell a $45/$50 vertical put spread expiring in one month. This involves:

- Selling a $50 strike put for $3.

- Simultaneously buying a $45 strike put for $1.

Your net credit would be $2 ($3 – $1) or $200 per contract. If the stock price remains above $50 by expiration, you would keep the entire $200 per contract. However, if the stock price falls below $45, you would incur max loss of $300.

Risk and Reward Profile:

Vertical spreads offer a defined risk and reward profile. The maximum potential loss and profit are predetermined at the outset of the trade, providing clarity and transparency. However, it’s important to carefully consider factors such as volatility, time decay, and underlying price movement when executing vertical spread strategies.

Recommended Books:

For those looking to expand their knowledge of vertical spreads and other aspects of options trading, two books stand out as quality resources:

- “Options as a Strategic Investment” by Lawrence G. McMillan – Widely regarded as the bible of options trading, this comprehensive guide covers a wide range of strategies, including vertical spreads. McMillan’s book provides in-depth explanations, real-world examples, and advanced techniques to help traders navigate the complexities of options trading effectively.

- “Option Volatility and Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg – Another good read for options traders, Natenberg’s book dives into the details of option pricing and volatility, essential factors in vertical spread trading. From basic concepts to advanced strategies, this book helps traders with the knowledge and tools needed to win in the options market.

Conclusion:

Vertical spreads offer a structured approach to options trading, allowing traders to capitalize on various market scenarios while effectively managing risk. Whether you’re bullish, bearish, or neutral on a particular stock or index, vertical spreads provide a flexible strategy to express your market outlook. By mastering vertical spreads and leveraging the insights from recommended books, traders can improve their proficiency in options trading.

Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to bring you quality content.