A diagonal spread is one of several spread trading strategies used by experienced options traders. The diagonal spread is essentially a combination of a vertical spread and a calendar (horizonal) spread. Combining elements of both, the diagonal spread offers traders a versatile tool to capitalize on both time decay, price movement and possibly a change in implied volatility.

Whereas the vertical spread includes options with the same expiration date, but different strike prices and the calendar spread includes options with different expiration dates and the same strike price, the diagonal trade involves options with different expiration dates and different strike prices. It is called a diagonal spread because when viewing a table or chart representing the spread, you could draw a diagonal line between the strike price in the earlier dated option and the different strike price in the later dated option.

Understanding Diagonal Options Spreads

A diagonal spread can be either a call diagonal or a put diagonal. These two strategies can be either bullish or bearish depending on how you structure the trade. This article focuses primarily on call diagonal spreads.

A call diagonal spread involves the simultaneous purchase and sale of call options with different strike prices and expiration dates. The bullish call diagonal is also called a poor man’s covered call since it is similar to a covered call but replaces the stock with a long call option. A bearish call diagonal spread combines elements of a call credit spread and a call calendar spread. With all of the diagonal spreads, you have limited upside profit potential and limited risk to the downside on the trade.

Implementing Diagonal Spreads

Traders initiate bullish call diagonal spreads when anticipating neutral or bullish near-term trend in the underlying stock price. The trader would buy a longer-term dated option and sell a shorter-term option. The strategy benefits from the increase in stock price and higher extrinsic value of the long option.

One example of a bullish call diagonal spread strategy is to buy-to-open (BTO) an in-the-money (ITM) option that is about 2 months until expiration. You would then sell-to-open (STO) an out-of-the-money (OTM) strike price option that is about one month until expiration. There will typically be a net debit to enter this trade.

For a neutral or bearish short-term outlook in the underlying stock, a trader can initiate a bearish call diagonal spread. The strategy benefits from a decline in stock price, with the short call option ideally expiring worthless while the long call option retains value.

An example of a bearish call diagonal spread strategy is to buy-to-open (BTO) an out-of-the-money (OTM) strike price option that is about 2 months until expiration. You would then sell-to-open (STO) an at-the-money (ATM) option that is about 1 month until expiration. There will typically be a net credit to enter this trade.

In either case, if you paid a debit when establishing the trade, the risk is limited to the difference between the strike prices plus the debit paid. If you received a net credit when establishing the trade, the risk is limited to the difference between the strike prices minus the net credit received. Maximum profit can vary depending on entry prices and changes in implied volatility (Vega).

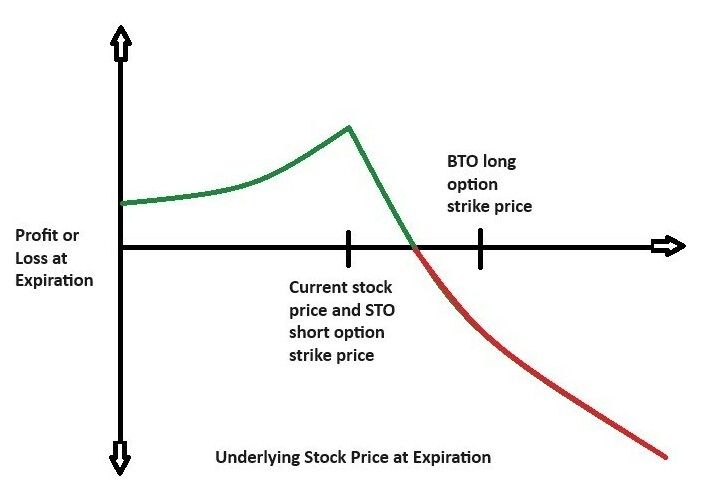

Below is a simplified, example of a possible profit/loss risk profile for a bearish call diagonal spread.

Some things to consider for getting the best entry price for the trade are making sure there is a tight bid/ask price, entering only at or close to the bid. Look for liquid stocks with liquid options at that strike price for the expiration dates selected. As always, use high quality charting tools, such as TradingView and FinViz to aid in your technical analysis.

Management of the Trade

Diagonal spreads profit from time decay of the shorter-term option and trend of the underlying stock. As time passes, the value of the short-term option in the spread decreases faster than the value of the long-term option.

Set predefined criteria for when you’ll adjust or exit the trade. This could be based on the percentage of profit or loss, changes in volatility, or time remaining until expiration.

For the bullish call diagonal, you can close the trade when your profit target is reached or nearing expiration of the short-term call. There is a risk of being assigned the stock prior to the short-term call expiration and you need to understand that and how to manage it if it happens. You could also open another short-term option or just choose to hold the long-term position if you believe the underlying stock price will increase from that point.

For the bearish call diagonal, the maximum potential profit depends on whether you also close the long-term call at the expiration of the short-term call. The long position could be held if you believe the underlying stock price will increase from that point. As discussed earlier, you could also open another short-term position.

Stay updated on market news, economic indicators, and events (such as earnings reporting) that could impact the underlying asset of your options trade. This information can help you make informed decisions about managing your diagonal spread.

Depending on how far out you chose expiration dates you may need to be patient and avoid making impulsive decisions based on short-term market fluctuations. Stick to your trading plan and strategy to avoid making decisions based on emotions. As with all trading, your trading psychology with options spreads can make or break your ability to be successful.

Risk Management and Position Sizing

Similar to many other options strategies, profits are capped with diagonal spreads. However, if you hold onto the long-term position after closing the short-term one, you can potentially realize higher returns, but it can also result in a larger loss.

Options involve leverage, offering the opportunity for substantial returns within a short timeframe. Conversely, this also means the risk of significant losses in a short period. It’s advisable to practice paper trading with this strategy before committing real money.

Real-world Example

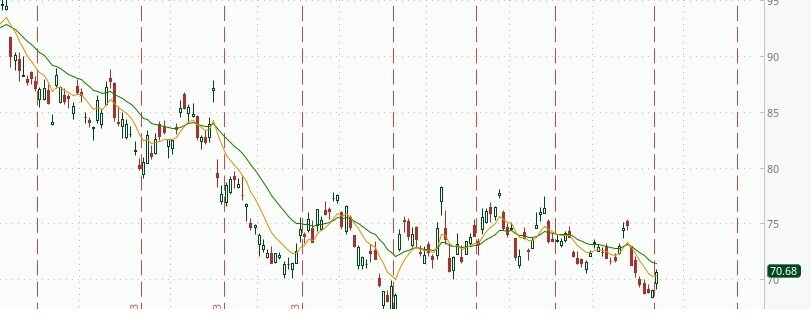

Here is an example of a stock that is trading at approximately $70, with a downward trend. Based on your technical analysis, you anticipate the trend to continue over the next month or more.

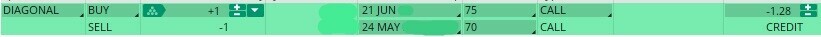

You open a bearish call diagonal spread using the following dates and strike prices. You buy-to-open (BTO) the $75 out-of-the-money (OTM) call with an expiration date of 21 June. You also sell-to-open (STO) a $70 at-the-money (ATM) call with an expiration date of 24 May. Based on the price for each call, you gain a net credit of $1.28 (or $128 per contract). Here is the trade:

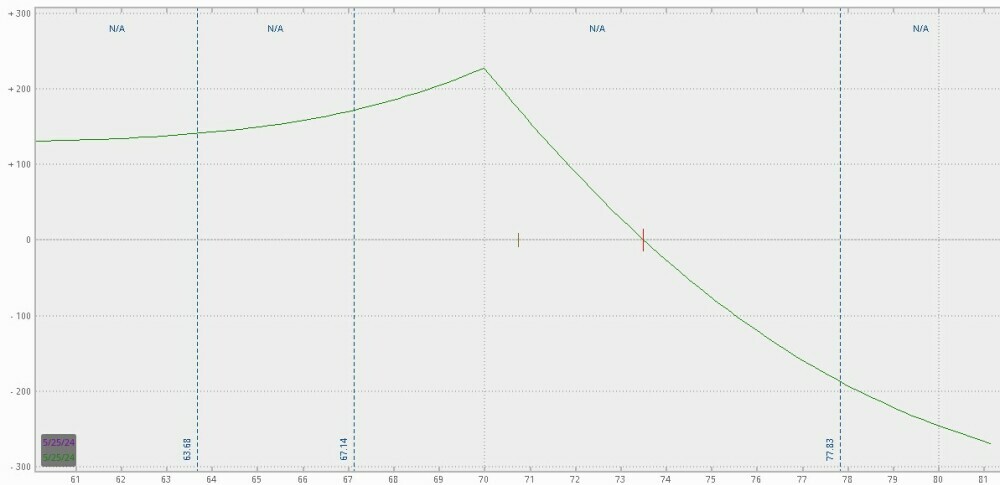

The risk/reward profile at expiration of the short position is shown below.

Conclusion

Call diagonal spreads are one of the potential tools you can use to be a successful options trader. They provide a unique opportunity to capitalize when you expect the underlying stock to remain neutral or trend in a specific direction and are looking to minimize risk in a trade. As always, use available technical analysis tools to aid in your determination of the forecasted price of the underlying stock and use good risk management techniques to maximize gains and minimize losses if the trade does not work in your favor.

**Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to bring you quality content.**

Disclaimer – The content of this article is for educational purposes only and should not be construed as a recommendation to purchase or sell any investment products.

As a newcomer to options trading, I’m keen to learn more and experiment with different tactics. This post provided a full description of diagonal spreads, which was quite informative for me.

The extensive explanations and examples have helped to clarify the concept and distinguish it from other tactics. This has prompted me to investigate using diagonal spreads into my trading strategy, seeing its adaptability and possible benefits.

Overall, I believe this post is an invaluable resource for traders of all levels. I’m excited to go deeper into the world of diagonal spreads and learn how they can improve my trading skills.

Thank you for the kind words in your comments Kiersti. I aim to provide quality content that will help others succeed in the world of trading.

The explanation of the diagonal option spread strategy was quite enlightening, especially for someone like me who’s relatively new to the concept. I do appreciate how you navigated the complexities of strike selection and expiration timing. In your next post, could you please give some real-world examples to see how these strategies play out under different market conditions.

Thank you for the thoughtful comment, Deon. I’m glad you were able to get some value from this article and I will plan a future post that provides additional real-world examples.