When I first stepped into the world of trading, I quickly realized that understanding market trends and having comprehensive knowledge of finance was only part of the battle. What I didn’t anticipate was how crucial psychology would become in my daily trading decisions. Trading psychology is the bedrock that underpins a trader’s methodology, discipline, and ultimately, their success or failure.

Every trader I’ve encountered comes face-to-face with a myriad of emotions and biases which, left unchecked, can lead traders astray. Fear, greed, hope, and regret are common feelings that can cloud judgment, causing one to stray from their established trading plan. I’ve seen firsthand how emotional reactions to market fluctuations can disrupt even the most seasoned trader’s strategy.

I’ve come to appreciate that discipline and self-awareness are the silent guardians of a profitable trader. Acknowledging the emotional rollercoaster and being equipped to deal with it is what separates professionals from amateurs. It’s not just about the numbers; it’s about how one responds to them.

Through my journey, the enlightening impact of psychological readiness is clear. Before diving into market analysis or the latest trading strategies, understanding the psychological elements at play can provide a foundation for better decision-making and improved long-term outcomes. This understanding has prompted me to curate a list of reading materials that I consider instrumental in shaping a trader’s psychological landscape.

Expert Recommendations: Top Books to Master Trading Psychology

When choosing books to guide you on the mental aspects of trading, I rely on a blend of author credentials, practical advice, and transformative insights. Each book I recommend comes from an author respected in the field, boasting a combination of academic, professional, and teaching experiences.

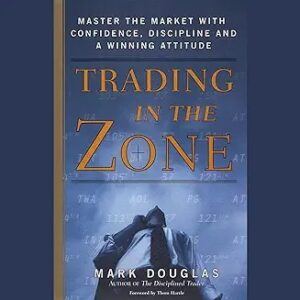

One standout is ‘Trading in the Zone’ by Mark Douglas. It’s a masterpiece that reveals how to think in probabilities and release attachments to specific outcomes. Douglas, a trader and trading coach, unpacks the idea of ‘trading state of mind’ and its influence on one’s success.

Another great book by Mark Douglas is ‘The Disciplined Trader: Developing Winning Attitudes’. Douglas demonstrates how the mental states that allow us to function effectively in society are often psychological barriers in trading. And then it shows the reader how to develop and apply attitudes and behaviors that transcend psychological obstacles and lead to success.

Then there’s ‘The Psychology of Trading’ by Dr. Brett Steenbarger, a clinical psychologist and active trader. His book delves into the narratives and emotions that shape our trading decisions, offering therapeutic strategies to align one’s mind with the markets.

Another essential read is ‘The Daily Trading Coach: 101 Lessons for Becoming Your Own Trading Psychologist‘ by Steenbarger. It provides actionable daily exercises that sharpen your self-coaching and adaptation skills.

For the data-driven, ‘Thinking, Fast and Slow’ by Nobel laureate Daniel Kahneman offers a deep dive into cognitive biases and heuristics that can misguide traders. Although not exclusively a trading book, its principles are profoundly applicable to trading psychology.

Lastly, ‘Mind Over Markets: Power Trading with Market Generated Information‘ by James F. Dalton, Eric T. Jones, and Robert B. Dalton gets into the nitty-gritty of market profile theory, linking psychological insights with market understanding.

These books have been selected not only for their content but for the conversations they’ve sparked among the trading community. The biographies and success stories influenced by these authors add depth to their ideas and provide valuable context for readers.

Deepening Understanding: How These Books Can Change Your Trading Game

I often see traders focus on strategies and market analysis but overlook the role their own psychology plays in their success. It’s crucial to address this, as the books on trading psychology I’ve recommended aren’t just to be read; they’re to be applied. The insights and strategies they provide have the potential to revolutionize your approach to the markets.

Each story and piece of advice is more than information; it’s a tool for building a stronger trading foundation. You’ll find that these books offer strategies for recognizing and controlling emotional responses, setting realistic goals, and executing trades with precision and discipline.

Consider the success stories of traders who attribute their turnaround to a psychological reboot. They often cite moments of realization sparked by an encounter with a passage or an exercise from one of these books. Their case studies serve as testament to the transformative power of a well-nurtured trading mindset.

But this is not just about avoiding emotional pitfalls or bad habits. It’s about building a new framework for decision making. These books guide you through developing that framework by fostering a deep self-awareness and an understanding of the market’s psychological landscape.

Implementing these lessons means using setbacks as opportunities to grow, developing resilience to the highs and lows of the market, and approaching each trade with a clear, focused mindset. All of this sets the stage for what comes next: integrating these insights into your daily trading routine.

Beyond Reading: Implementing Psychological Best Practices in Your Trading Routine

Understanding the psychology behind trading is a game-changer, but reading alone won’t transform your trading habits. It’s ACTION that cements learning.

A personalized trading psychology plan can set you on the right path. Start by establishing clear goals and identifying your emotional triggers. Write them down and refer back to them to stay on course.

Emotional control is crucial. Develop a routine that includes checking in with your emotions before, during, and after trades. Ask yourself, ‘Am I making decisions based on logic or emotion?’

Consistency in decision-making is equally important. Keep a trading journal to track your thought processes for each trade. This can help identify patterns in your behavior that require attention.

Many of the books suggest specific exercises like meditation or breathing techniques to manage stress. Adopt these practices into your daily routine to help maintain mental clarity.

Lastly, remember that mastering trading psychology isn’t a one-time event. It’s a continual process of learning, adapting, and evolving as markets change and as you grow as a trader. Stay committed, stay learning, and expect your discipline to pay off.

**Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to bring you quality content.**

Hi there,

Thank you for sharing your thoughtful approach to selecting books on the mental aspects of trading. I can only imagine that your criteria of considering author credentials, practical advice, and transformative insights would resonate deeply with many traders.

Your recommendations encompass a rich tapestry of insights that undoubtedly enrich the journey of any trader committed to mastering the mental game of trading.

Well done.

Thank you for your kind words about this article. I’m pleased that you were able to glean key insights from the content.

I have zero experience with trading, and I would feel like a freshly wounded lamb in a wolf’s den. I have so much to learn about trading on the stock market and cryptocurrency. I could benefit from some of the books you have mentioned, possibly all of them lol.

This article has given me some great books to read along with my research that I desperately need to do. Considering my experience level, which book would you recommend I start with, possibly can you provide a list of 5 must-reads for me as well.

Thanks, Stacie

Hi Stacie,

Thank you for your comments. If I had to pick one of these books to start with it would be ‘Trading in the Zone’. Regarding books that focus on the mechanics of trading, it depends on your goals. Some enjoy the thrill of day-trading, others are more comfortable with swing trading and lastly those doing it as a long-term investment. I will be adding additional articles to my website at a future date that will provide some clarity on those topics. I also recommend that new traders ALWAYS start with a simulated trading account. It won’t mimic the exact emotions of trading since there is no fear of a real loss of money, but it gives you the opportunity to learn the mechanics to see what works and doesn’t work before putting real money on the line.

Robert